The COVID-19 pandemic accelerated the world’s transition into the digital space, bringing lasting changes to how we live, work, learn, and connect. In the post-COVID era, digital platforms are no longer just a convenience but they are essential for managing daily tasks efficiently and with fewer obstacles. From virtual healthcare and remote education to e-banking, work-from-home models, and online business operations, digital solutions have become standard across industries. As a result, people now expect interactions to be faster, safer, and more flexible. As technology continues to advance, the digital space has become the new foundation of modern life. The key challenge ahead is not just widespread adoption, but ensuring a responsible, inclusive, and secure digital transformation for everyone.

1. Virtual healthcare

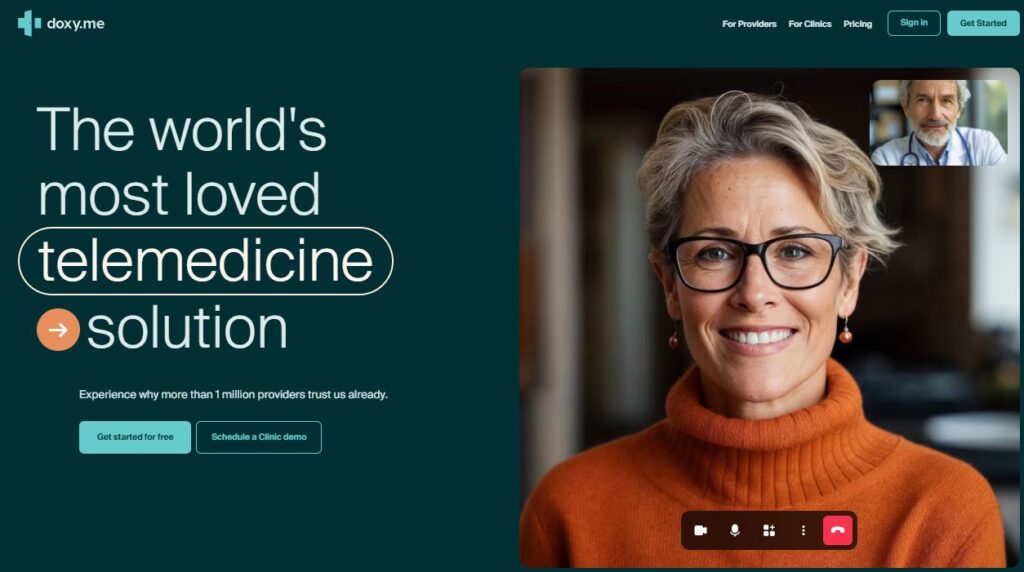

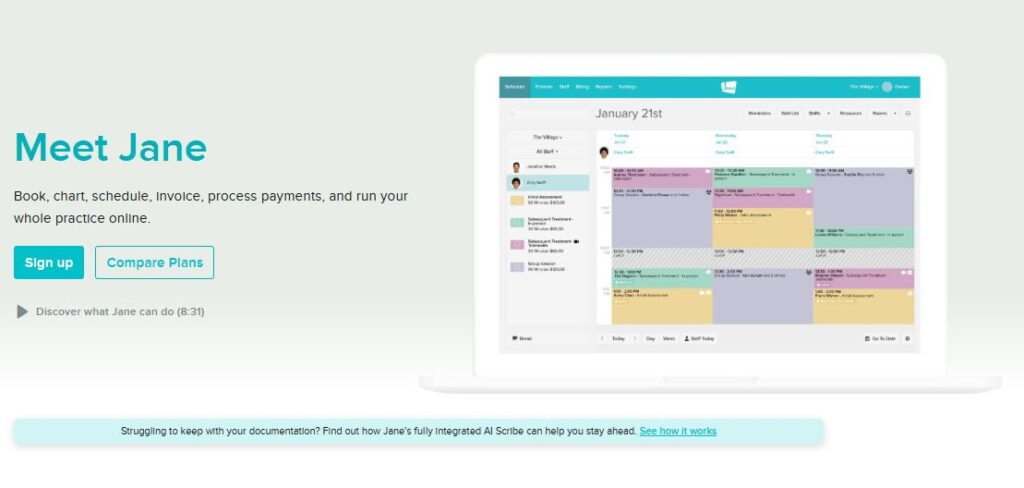

Virtual healthcare (also called telehealth or telemedicine) refers to delivering healthcare services remotely using digital communication tools – DOXY, ZOOM, JANE APP instead of requiring an in-person visit. It connects patients and healthcare providers through technology such as video calls, phone consultations, mobile apps, chatbots, and remote monitoring devices.

Photo courtesy: DOXY

Photo courtesy: ZOOM

Photo courtesy: Jane App

2. Electronic Banking

Post COVID-19 pandemic, e – banking experienced a significant transformation. What was once a convenient alternative rapidly became the primary channel through which individuals and businesses interacted with financial institutions. The shift to digital platforms was driven by lockdowns, social distancing measures, and the growing demand for faster, safer, and more accessible banking solutions. As a result, electronic banking has evolved into an essential service, reshaping customer expectations and the overall future of the financial sector. Lockdowns forced customers to shift from physical branches to online banking apps, ATMs, and mobile wallets. Even older generations, who preferred face-to-face banking, adopted digital services.